Any company stands to benefit from automating their material- and service-sourcing processes, and many turn to strategic sourcing platforms to do so. They would do well to begin by clarifying what their strategic sourcing management solution must accomplish according to their specific niche and the most immediate supply chain links that impact their operations. Parts Analytics assembled several of the brightest minds in strategic sourcing management software to explore the current state of the technology.

Speed and Flexibility for Quality Upstream Connections

Much depends on clarifying the crucial factors related to how sourcing teams decide to buy services rather than accomplish them in-house – and further, what criteria they rely on to select the right service provider. As the conversation developed with the materials-sourcing team in mind, it was noted that the operative use they expect from their sourcing platform at the time of decision-making is research and statistics to peers (RS2P).

This is their bread-and-butter for transactional procurement activities that will have the most immediate and long-lasting impacts, and to do so, they must be able to obtain firm decisions from their design team while still accommodating their need to leave certain design challenges open to possibilities.

The trick, as the team discussed, is in bridging the gap between product design processes, when exact material needs are unknown, and the sourcing teams, who need to move ahead with supplier relationships based on the best possible estimates throughout the development lifecycle. Pressure in either direction could water down the design on the one hand and result in weaker supplier relationships on the other.

There must be an upfront mode process in place to begin with so that decisions made by the design team most effectively, even if gradually, help to establish exact materials sourcing needs as they are known. This is what will help the sourcing team know where to look upstream while simultaneously giving the downstream manufacturing team a reliable timeframe, and the same dynamic applies to finding service providers.

The full life cycle of the product, from design to production, requires what could be seen as either problematic gaps or a useful sign that the team requires flexibility for greater quality. Matters which seem indirect at first could be the space that breeds superior decisions if a healthy margin between data and action is respected.

What is that healthy margin, though? This was at the heart of the discussion, because it is the sweet spot where the development of entirely new categories of tools is necessary to bridge these gaps.

A Constantly Fluctuating Supply Chain

As the conversation evolved, the issue of timing was further emphasized. Upstream and downstream partners are necessarily going to keep moving in their own right, and by implication, current or potential partners may be less or more favorable to the company’s needs when those needs are firmly established.

The best strategic sourcing platforms leave the contract piece of the puzzle almost wholly up to the client, who can make superior use of the software according to their own unique criteria. If an element escapes even the most dedicated efforts to quantify it, it’s likely that it is something best left to those who must necessarily make qualified judgment calls.

There is much that goes into that judgment, though, and much that can be done to improve the quality of those decisions by keeping key decision-makers as well-informed as possible with the most contextually relevant data related to the links in the supply chain that most closely (1) affect those decisions and (2) will be affected by those decisions.

Except for all but the most service-based models, direct materials sourcing is always going to be taking place, even if just to achieve redundancy. This is a constant that the design, manufacturing, and sourcing teams all depend on, and so sourcing management platforms have always put an emphasis on clear project development mapping and the ability for each department to share the most relevant materials and services needs.

This allows each team in the development sequence to control information flow without being overloaded with irrelevant data – rather, they are able to obtain the most useful and time-sensitive information on actual and potential costs, savings, risks, and other vendor-comparison metrics according to the most recent decisions made company-wide.

From core commonalities, each team is reliant on each other’s data and able to help shape how that data should be presented with each other’s purposes in mind. For example, the design team will want an emphasis on material properties, which is easy enough to do from a parts-analysis standpoint – it only requires clarity on the full gamut of material properties that are required and the ability to obtain industry-specific knowledge to compile the relevant data. That is as direct as it gets.

Indirectly, the materials-sourcing team, in their search for suppliers, will not know which material qualities are most important for manufacturing until the design team uses the sourcing team’s information about the availability of materials to reach a final design most appropriate for the realities of their immediate upstream (supplier) and downstream (manufacturer) links.

The sourcing team will nevertheless want to stay busy keeping their options open and engaging in vendor negotiations to whatever extent possible in order to keep their upstream strong – and this can be only done according to how well they can operate off of the indirect knowledge they have about current and future product development.

Maintaining Direction

To further exemplify the difference between design and supplier needs, a supply-sourcing team can act effectively when it’s known that there is some need for higher-grade material, even if it is not yet known how much of that need there will ultimately be. The company can still spend their time comparing suppliers and costs according to a range of pricing at different volumes without needing to know the exact quantities needed.

They can even look further upstream to estimate shifts in the supply chain that would alter those prices. This is an example of a value-added activity that strategic sourcing platforms can facilitate even with mostly indirect materials data.

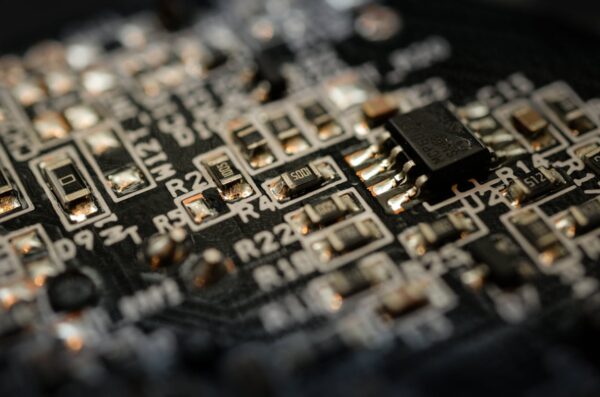

This is a common situation for EMS companies that manufacture a wide range of circuit boards in a variety of industries. If they are just as likely to be designing future products for the computer industry as for the medical industry, for example, they don’t yet know whether a circuit board supplier should be chosen according to the tightest component spacing (as is primary in computer manufacturing) or wider spacing with more testing points (as needed in medical device manufacturing).

In this case, strategic sourcing platforms enable sourcing teams to analyze far-upstream factors that are sure to impact PCB suppliers of any kind.

This directly involves the way downstream manufacturing contracts are selected. If an EMS materials-sourcing team determines that one product over the others will have potentially higher profit margins due to its cheaper source materials, then that will guide decisions related to which EOM companies will be more profitable to work with at that time.

An ODM company, however, is much more locked into the product niche they’re committed to because they’re trying to leverage their own intellectual properties. In that case, too much indirect knowledge for too long becomes a limitation for the materials-sourcing team.

At the same time, the right customized strategic sourcing platform can help the design team use such indirect data to more quickly reduce their design options and arrive at a final design, then begin feeding direct data based on their decisions.

Direct information has a much higher premium for ODMs, in relation to the nature of their work, and strategic sourcing software will help them leverage the indirect data to more quickly arrive at the decisions necessary to provide much-needed direct data to the sourcing team.

In any company, more can be done with direct materials analyses, which requires having a firm target in mind, but the need to make use of indirect data is still there. For many reasons that are not easily quantifiable (or perhaps not quantifiable at all), the need for flexibility in strategic sourcing algorithms is always going to be there.

On this issue, the team emphasized that indirect-sourcing software solutions are operating on technology built more recently, being about a decade more technologically advanced. Direct sourcing still relies heavily on simple tools that require much more effort to find database management solutions approaching the same level of automation as modern indirect-sourcing analytics tools.

Direct data is generally more useful but the tools are not more inherently automated than indirect analytics software.

Cohesion Between Subsystems

It’s a matter of having a full ecosystem instead of overly disjointed subsystems – that is what vendors such as Parts Analytics and clients who purchase strategic sourcing platforms are involved in together. Part of that full ecosystem is knowing how much of a custom sourcing platform must be tailored to P2P, S2P, and RS2P.

It’s the balance that matters, because the capabilities of any of the three are all well-advanced in their own right. They must, though, become far more than the sum of their parts.

Redundancy also improves the overall system while simultaneously shaping how the full ecosystem more cohesively bridges its interrelating subsystems. Having multiple subsystem tools to rely on will strengthen the overall capabilities of the entire management system.

Contract lifecycle management and in-house lifecycle management rely on the same category of tools, but those tools need to be oriented to different relationships and an awareness of respective needs, lest any peer relationship become decontextualized and less relevant to the whole. Every team benefits from mutually helpful contextuality, and this further benefits those direct links in the supply chain who will enjoy the ability to receive quicker decisions from their partners.

Considering the inter-relational dynamics of contracts between links in the supply chain, there is a necessary blend of compartmentalization and transparency that their respective systems-management providers must be sensitive to. What enables their systems to work efficiently together is the level of cohesion their strategic sourcing platforms provide each company separately in one view, and both companies together from a larger view.

Seamless Differences

Without becoming disjointed, there is compartmentalization that goes on even in the most open data-sharing relationships simply to ensure that only contextually useful data is given to the right place at the right time. Two-way communication between subsystems (and between those subsystems and the overall system) will involve a blend of compartmentalization and easy, barrier-free communications. How the two should be balanced is the responsibility of the company designing custom strategic sourcing platforms.

This is how Part Analytics approaches every strategic sourcing relationship, because it is the connection between the products, services, and contracts that itself is the product our clients – from major Fortune 500 companies to promising young SMBs – rely on us for.